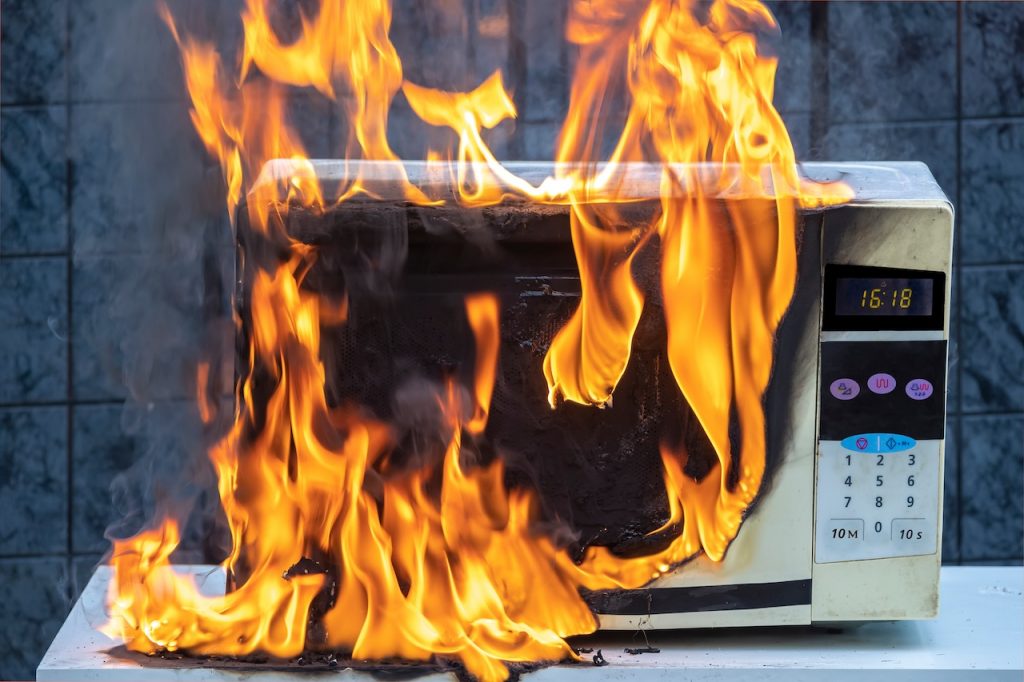

Fire damage is one of the most devastating emergencies tenants can face, often leaving behind destroyed belongings and financial uncertainty. If you’re wondering, does renters insurance cover fire damage? The answer is yes—but the coverage can vary based on your policy and provider. In Wisconsin, understanding fire damage coverage, how to file claims, and knowing your tenant rights are essential steps to protect yourself from unexpected disasters.

What is Renters Insurance?

Renters insurance is a policy designed to protect tenants from financial losses due to unforeseen events.

Renters insurance typically covers three main aspects:

- Personal Property Coverage: Reimburses for damaged or destroyed belongings.

- Liability Protection: Covers legal costs if someone is injured on your rented property.

- Additional Living Expenses (ALE): Pays for temporary housing if your rental becomes uninhabitable.

Fire damage falls under personal property coverage and ALE, making it a key reason many tenants purchase renters insurance.

What Fire Damage Does Renters Insurance Cover?

Electronics are usually covered in fire-related incidents.

When it comes to fire-related incidents, renters insurance generally covers:

- Personal Belongings: Clothing, electronics, furniture, and other possessions damaged by fire.

- Smoke Damage: Items affected by smoke, even if they weren’t burned.

- Water Damage from Firefighting Efforts: For example, items ruined by sprinklers or fire hoses.

- Temporary Housing: If the rental is uninhabitable, your policy may pay for hotel stays or similar accommodations.

However, policies often have limits, so high-value items like jewelry or art may require additional coverage.

How to File a Renters Insurance Claim After Fire Damage

Filing a claim after fire damage can be a daunting process.

Here’s a step-by-step guide on how to file an insurance claim after a fire:

- Ensure Safety First: Make sure you and your loved ones are safe and away from the affected area.

- Contact Your Insurance Provider: Notify your insurer about the incident as soon as possible.

- Document the Damage: Take photos or videos of the damage to provide evidence for your claim.

- Provide a List of Damaged Items: Include receipts or estimates of the items’ value if possible.

- Work with the Claims Adjuster: Your insurer will assign an adjuster to evaluate the loss and determine the payout.

Quick action and detailed documentation can make a significant difference in the claims process.

Comparing Renters Insurance Providers in Wisconsin

Choosing the right renters insurance provider is crucial to ensure comprehensive coverage for fire damage. Here are some top options to consider in Wisconsin:

- State Farm: Offers affordable premiums and customizable plans.

- Allstate: Known for its user-friendly claim process and discounts for bundled policies.

- Geico: Provides competitive rates and excellent customer service.

- Progressive: Offers unique features like inflation protection for policyholders.

When comparing providers, consider factors like premium costs, coverage limits, customer reviews, and additional benefits.

State Regulations and Tenant Rights in Wisconsin

Wisconsin has specific tenant rights and regulations designed to protect renters in cases of fire damage:

- Security Deposits: Landlords cannot use your security deposit to repair fire damage unless caused by tenant negligence.

- Landlord Obligations: They must maintain a safe and habitable rental property.

- Eviction Protections: Tenants cannot be evicted due to damage caused by a fire unless they are at fault.

Familiarizing yourself with these laws can help you navigate disputes and assert your rights effectively.

Does Renters Insurance Cover Negligence-Related Fires?

Renters insurance typically covers accidental fires but may exclude those caused by gross negligence. For example, if you left a candle burning unattended, your claim could be denied. Always review your policy’s fine print to understand these exclusions.

Protect Yourself from the Unexpected With PuroClean of Burlington

Fire damage is unpredictable and costly, but renters insurance offers a safety net for tenants in Wisconsin. If a fire damages your home, you’ll need the help of professionals. PuroClean of Burlington will determine the full extent of the damage to your residential or commercial property. We will then provide all the necessary fire damage restoration services, from structural support to board-ups. Our team will pack your belongings with compassion and respect, listen to your concerns, and work diligently to clean and deodorize your property. Contact us today at (262) 342-2226 to get started.

PuroClean of Burlington

PuroClean of Burlington