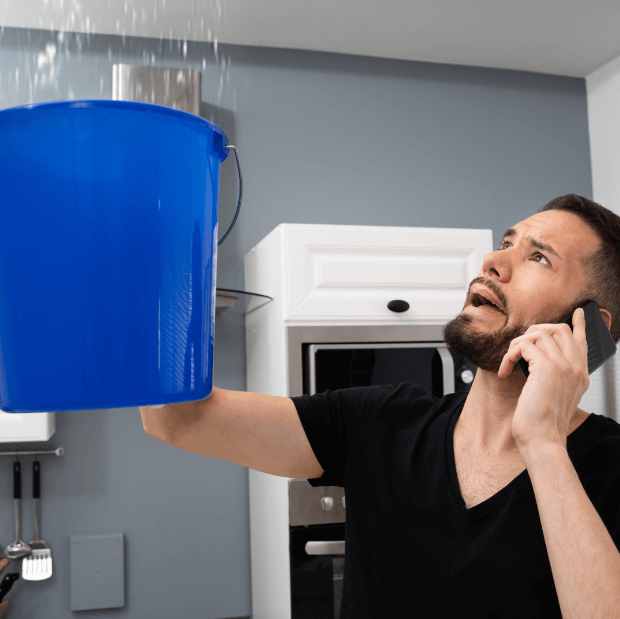

Water damage can be a nightmare, causing significant harm to your property and belongings.

Understanding your water damage insurance coverage is crucial. It will help you know what is covered and what isn’t before disaster strikes.

This article will guide you through the intricacies of water damage insurance. We’ll discuss what it typically covers, common exclusions, and the claim process.

Understanding Water Damage Insurance Coverage

Water damage insurance coverage is a part of your homeowner’s insurance policy. It covers the cost of repairs from water damage in your home.

However, not all types of water damage are covered. The coverage largely depends on the source and cause of the damage.

It’s important to read your policy carefully to understand the specifics of what is covered and what is not.

Knowing the details can save you from unexpected expenses. It can also help you make informed decisions when filing a claim.

What Does Water Damage Insurance Typically Cover?

Water damage insurance typically covers damage caused by sudden and accidental water events. This includes situations like a burst pipe or a water leak from your washing machine.

- Burst pipes

- Leaking appliances

- Vandalism

- Rain or snowstorm

- Accidental overflow of water or steam from plumbing, heating, air conditioning, or automatic fire-protective sprinkler system

Remember, the key term here is “sudden and accidental”. Gradual damage, which occurs over time, is usually not covered.

Common Exclusions in Coverage

While water damage insurance can be a lifesaver, it doesn’t cover everything. There are common exclusions you should be aware of.

- Floods

- Sewer backups

- Ground seepage

- Poorly-maintained pipes leading to leaks

These exclusions mean that damage from these sources won’t be covered by your standard policy. You may need additional coverage or a separate policy for these situations.

The Claims Process: Step by Step

Filing a water damage insurance claim can be a daunting process. But understanding the steps can make it easier.

First, you need to assess the damage. Determine the source and extent of the damage.

Next, contact your insurance company and report the damage to start the claims process.

Your insurance company will then send an adjuster. They will inspect the damage and estimate the cost of repairs.

Finally, you’ll receive a payout based on your policy’s terms and the adjuster’s report.

Immediate Steps to Take After Discovering Water Damage

When you discover water damage, act fast by stopping the source of the water, if possible.

Next, ensure safety by turning off electricity in the affected area to avoid electrical hazards.

Finally, document the damage. Take photos and make notes before you start any cleanup.

Documenting the Damage to Your Claim

Proper documentation is crucial for your claim. Include damaged items in your documentation. Make a list of all affected items, their value, and the cost to replace them.

Keep receipts if you make any immediate repairs. These can be useful when filing your claim.

Filing Your Claim: What You Need to Know

When filing your claim, be thorough. Provide all the documentation you’ve gathered.

Be prepared to negotiate. The initial payout offer may not cover all your repair costs.

Finally, understand your policy’s time limits. File your claim as soon as possible to avoid missing the deadline.

Hiring Professional Water Damage Restoration Services

After a water damage event, professional help is often needed. Water damage restoration services can help restore your property to its pre-loss condition.

These professionals have the tools and expertise to handle water extraction, drying, and dehumidification. They can also handle mold remediation, a common issue after water damage.

The Role of Water Mitigation and Restoration

Water mitigation is the first step in the restoration process. It involves preventing further damage by removing water and drying the property.

Water restoration, on the other hand, involves repairing or replacing damaged items. This can include everything from flooring and drywall to furniture and personal items. Both steps are crucial to fully recover from damage.

Preventing Future Water Damage

Preventing water damage is always better than dealing with its aftermath. Regular maintenance and inspections can help identify potential issues before they become major problems.

Proactive measures can save you from the stress and cost of water damage. These include keeping gutters clean, checking for leaks regularly, and maintaining appliances that use water.

Remember, water damage can occur anywhere in your home so stay vigilant and proactive to prevent it.

Regular Maintenance and Inspection Tips

Regular maintenance is key to preventing water damage. This includes checking your plumbing system for leaks and maintaining your HVAC system.

Inspect your roof regularly for signs of damage. A damaged roof can allow water to seep into your home, causing significant damage.

Also, keep an eye on your appliances. Washing machines, dishwashers, and refrigerators can all cause water damage if they leak or malfunction.

Technological Solutions for Water Leak Detection

Technology can also help in preventing water damage. Water leak detection systems can alert you to leaks before they cause significant damage.

These systems can be installed in areas prone to leaks like kitchens and bathrooms. They can detect even small leaks and alert you immediately.

Smart home devices can also help. Some devices can shut off the water supply if a leak is detected, preventing further damage.

Conclusion: Ensuring Adequate Water Damage Insurance Coverage and Peace of Mind

Understanding your water damage insurance coverage is crucial. It helps you know what is covered and what isn’t, allowing you to make informed decisions in case of water damage. Regularly review your policy and ensure it provides adequate coverage for your needs.

Remember, prevention is always better than cure. Regular maintenance and inspections can help prevent water damage. But when it does occur, knowing you have adequate coverage can provide peace of mind. Stay informed, stay prepared, and you’ll be able to handle any water damage situation that comes your way.

PuroClean of Jacksonville Southbank offers expert water damage restoration services and can guide you through the insurance process. Don’t let water damage become a nightmare—take action now to safeguard your home and belongings. Contact us today for reliable restoration and insurance assistance!

PuroClean of Jacksonville Southbank

PuroClean of Jacksonville Southbank